labor (Mostly) Useful Government Numbers About Poverty, Jobs, and Unemployment, Including the Latest Employment Report for February 2024

A Failed Number

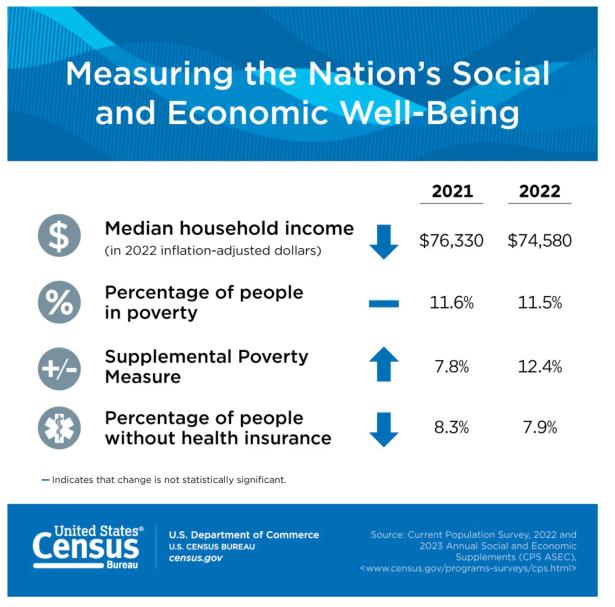

Does the Federal Government regularly publish estimates of what a reasonably comfortable living standard would be for an average household? There must be something somewhere. A government agency does publish poverty lines--aka, poverty thresholds--and its experts tell us how many people fall below the lines. In spring, the Census Bureau gathers income and other information on the preceding year and publishes the results in September. The last report was Poverty in the United States: 2022.

According to this publication the proportion of the population that was poor in 2022 was 11.5%. That is the poverty rate. There are rates for many categories, including ethnic groups and households with no workers. Recently the Bureau created Supplementary Poverty Measures (SPM) which offer more information than the official poverty rate. But the SPM poverty rate was just 12.4%, so it does not change the basics, and it has not incentivized me to master the details of the SPM. The big picture for me is that each poverty measure is totally inadequate, especially in a country that is overflowing with riches. The poverty lines are given on page 18 of the 2022 report. The line for a family of four with two young children was $29,678. The line for singletons 65 or older was $14,036. Think about those numbers for half a minute. A family of four with $30,000 a year was not officially poor in 2022.

By this reckoning, a $15 an hour job for 2000 hours a year puts a family over the poverty line. And $25 an hour for 40 hours every single week is heaven: $52,000, before Social Security and other deductions. In reality, even that isn’t heaven for a family of four. Isn’t it clear? We need new poverty lines that reflect economic realities, one of which is that living standards and the total wealth of the nation have zoomed upward since the lines were first developed in the 1960s.

Real Earnings is Real Useful

More useful than current poverty lines is the Bureau of Labor Statistics (BLS) monthly report whose title is Real Earnings. This short publication covers all non-farm private-sector employees and includes a subset of information on production and non-supervisory workers, i.e., a more working-class group than that of all employees. In this publication you will find bar graphs and tables on changes in real pay—that is, with the effects of inflation removed. For example, in January of 2024 hourly pay checks looked like they had increased by 4.8% from January of 2023, but after inflation, the real purchasing power of the average wage grew by just 1.8%. Nothing to write home about. Yet that was better than the previous January-to-January change in real earnings which was -0.9%.

In this publication you will find numbers on various aspects of earnings and a Consumer Price Index which shows many things, including that prices rose by 6.2% between January 2022 and January 2023, but only 2.9% the following year. However, if you want to do a lot of work with prices and on an array of items, you should use the monthly BLS publication called Consumer Price Index.

Labor Flows

An underused batch of statistics that provides a surprising conclusion has to do with labor flows. Where do most people who find jobs in a particular month come from? Well, they must have been unemployed in one month and employed in the next, right? Turns out that is not quite right. Of 6 million newly employed workers in January 2024, most of them were not searching for work in the previous month, that is, they were not taking at least one of what the BLS defines as active job-search efforts, such as contacting an employer about a job or seeking assistance from friends and relatives about job leads. So they weren’t “unemployed.”

In January 2024, of all newly employed persons only 1.3 million had been officially unemployed in December. But 4.7 million had not been in the labor force—i.e., neither working nor looking for work in approved ways, but they found jobs.

Why are these things useful information? Because they give support to the idea that the population of job-wanters and needers is always much larger than the people who are actively searching for work. There are always millions of people out there who are essentially unemployed and who are on the lookout for good job opportunities but are not counted as unemployed. Many of them eventually find jobs.

The population of job-seekers is always much greater than the BLS’s unemployed population. It is closer to National Jobs for All Network’s (NJFAN) Full Count which adds part-timers who want full-time work and people who say they want jobs but have not searched recently. A big conclusion from all this information is that even when the official unemployment rate is 4% or 3.6%, we are not close to full employment, although many of our leaders and experts think we are.

Unemployment Claims as an Indicator?

One statistic that commentators and policy makers like to watch is the number and trend of weekly initial claims for unemployment benefits. Every week the New York Times Sunday business section on page 2 includes the most recent four-week average of initial claims. Most of the time, of late, initial claims have been on the low side—over 200,000 but below 250,000. The latest average for the four weeks ending in early March was 212,000. In past years, the number has been higher, and of course during the pandemic, unemployment numbers went through the roof. The number of officially unemployed workers jumped overnight to 21 million. In one week in April 2020, there were six million initial claims for unemployment benefits. And at one point, over 30,000,000 people were getting some kind of benefits, including regular unemployment benefits and special pandemic benefits, some of which went to gig workers who are outside the unemployment insurance system.

Normally, a fairly small fraction—about a third--of those who are unemployed are getting benefits. Part of the explanation for why more are not getting aid is that some people think they are not eligible and don’t apply. Some are ineligible according to current rules. Others think they will find new jobs soon. Some people are not considered employees, and so their employers do not pay into the UI system. (In California, employers spent millions to quash legislation that deemed gig workers such as Uber drivers to be employees.)

FYI: The numbers on initial claims and ongoing benefits can be found in the Department of Labor’s weekly publication called Unemployment Insurance Weekly Claims. It appears every Thursday.

And Finally, The Employment Situation

The most important document on jobs and unemployment, the one the experts wait for every month, is the BLS report which this month appeared as The Employment Situation—February 2024. The report usually appears on the first Friday of the month. It runs about 40 pages and contains thousands of useful numbers on jobs and unemployment rates for dozens of groups. There are two numbers that experts and commentators are especially keen to know: the overall unemployment rate and the number of jobs added or subtracted by non-farm employers. In February, those employers added 275,000 jobs—a healthy number and more than some had predicted. (ADP, a payroll processing firm, predicted an increase of 140,000.) Meanwhile, the unemployment rate rose a bit from 3.7% to 3.9%. We hope that such an uptick is not a sign of much higher rates of unemployment in future months. In terms of the official unemployment rate, the last two years have been very good: the official unemployment rate has not once gone as high as 4%.

While things have been quite good by conventional standards, my colleagues and I at NJFAN--and many other people too—believe that official unemployment rates substantially underestimate the size of the unemployment problem. Every month NJFAN publishes its Full Count, which uses federal data to construct a more realistic representation of the facts. We highlight rates for key groups such as Black Americans and disabled workers. We also create a more realistic unemployment rate by adding to the “officially” unemployed group these people: part-timers who want full-time work and people who say they want a job but have not searched recently. In the latter group are some who have looked for work in the past year but not recently. Some have not searched recently because of child-care responsibilities, disabilities, and pessimism about finding a decent job. While official unemployment in February was 3.9%, NJFAN’s Full Count was 9.6%. In other words, there was a lot of hidden unemployment.

[Frank Stricker is on the board of the National Jobs for All Network. He wrote Why America Lost the War on Poverty (2007) and American Unemployment: Past, Present, and Future (2020). He is emeritus professor of history and labor studies at Cal State University, Dominguez Hills.]

Spread the word